|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2pbz34wsl The Best CRM for Insurance Agency: Top Features and BenefitsChoosing the right CRM for your insurance agency can significantly enhance productivity, client management, and overall efficiency. In this article, we explore some of the top CRMs specifically tailored for insurance agencies and highlight their key features and benefits. Understanding the Importance of CRM in InsuranceCustomer Relationship Management (CRM) systems are critical for insurance agencies to manage client data, track interactions, and streamline operations. They offer a centralized platform to store information, enabling agents to provide personalized services efficiently. Enhanced Client ManagementCRMs help insurance agents keep track of client details, policies, and claims, ensuring no opportunities are missed and each client receives tailored service. Streamlined OperationsBy automating routine tasks, CRMs free up time for agents to focus on more strategic activities, such as generating new leads and retaining clients. Key Features to Look for in a CRM for Insurance

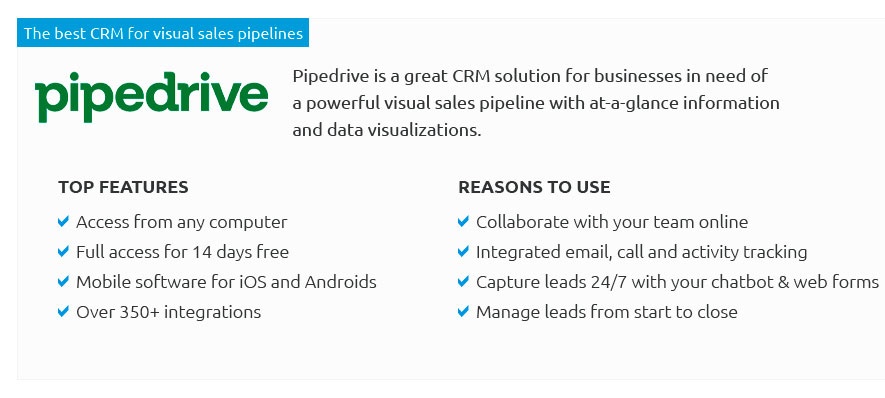

For those interested in exploring comprehensive plans, consider checking a sales and marketing plan example to integrate your CRM effectively. Popular CRMs for Insurance AgenciesAgencyBlocAgencyBloc offers industry-specific features like policy management and commission tracking, making it a popular choice among insurance professionals. Zoho CRMKnown for its affordability and scalability, Zoho CRM provides a robust platform for managing leads and automating workflows. InslyInsly focuses on policy lifecycle management and provides tools that help agents manage their portfolios efficiently. Benefits of Using a CRM for ProspectingA CRM can greatly enhance your prospecting efforts by organizing data and providing insights into client needs. For further insights, explore the best CRM for prospecting which highlights tools that excel in identifying and nurturing leads. FAQs

https://www.insurance-forums.com/community/threads/best-crm-for-super-small-independent-agency.104565/

Guru ... RadiusBob is good.. I do like their SoA and screen sharing capability. I wish they had a scheduling feature, like acuity or scheduly. I ... https://www.quora.com/How-do-I-find-the-best-CRM-for-insurance-agents

Choose a CRM specifically designed for insurance agents, offering policy tracking, claims management, and automated follow-ups. https://www.nocrm.io/use-cases/insurance-crm

noCRM is the best CRM I ever experienced. First, the navigation through the software is fluid and user-friendly. You even have the choice to take a picture of a ...

|